The timeline has been accelerated. Xi Jinping, President of the People’s Republic of China, said the country needs to “seize the opportunity” of blockchain technology.

“[We must] clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.” - Xi Jinping

These comments by Xi come only months after reports that China’s central bank will begin launching a state-backed digital currency within the end of the year to seven institutions. From there, these institutions will begin circulating the stablecoin to China’s 1.3 billion citizens.

Following up, the Standing Committee of the 13th National People’s Congress in China passed a new cryptography law, stating that:

“Clear guidelines and regulations are needed to evaluate commercial cryptography technologies used in the major fields related to the national interest as the current ‘loose’ system is not suitable for the industry anymore.”

Notice that this provision is aimed at encouraging nationwide educational efforts to promote cryptography among government officials, companies and social groups.

Before diving into this further, let’s first turn to the United States.

What’s America Thinking?

The news of China’s blockchain support came only days after Mark Zuckerberg’s testimony in front of Congress. He spent nearly six hours attempting to calm the fears of legislators about Facebook’s intentions with their own digital currency, Libra. His point mainly boiled down to a slightly chilling, “Let us launch this, or China will.”

“As soon as we put forward the white paper around the Libra project, China immediately announced a public private partnership, working with companies . . . to extend the work that they’ve already done with AliPay into a digital Renminbi as part of the Belt and Road Initiative that they have, and they’re planning on launching that in the next few months.”

If you’re still not sold on the idea of monetary policy run by math and code instead of people in power, do yourself a favor and watch the six hour testimony. After only fifteen minutes, you’ll come to realize that many people in power are seemingly inept at managing the world’s largest economy, let alone any economy. The hearing was meant to discuss the implications of disrupting the entire global financial system as we know it. Many representatives instead took their few precious minutes with the microphone to dispute anti-vaccinators being censored from a website.

While the sound bites of discrimination and content moderation controlled headlines, Zuckerberg maintained a pretty clear and sharp viewpoint. To my surprise, a few representatives did actually understand the gravity of the situation and even went as far as questioning Zuckerberg if he understands the power that the United States has to lose:

"If we don't innovate, there's no guarantee that we can extend those same rules and project that kind of influence around the world going forward.”

And say what you want about Congressman Brad Sherman, but he may have proven to be one of the more informed legislators on bitcoin’s potential. Give this a listen:

He as a member of congress and, along with his colleagues, represent the world's largest economy, one that retains this status due to the benefits of controlling the reserve currency provides. He understands bitcoin’s value proposition and is one of the vocal few fighting to retain the exact powers bitcoin seeks to take away from him. While his ideals are misplaced, his knowledge on what a bitcoin future may look like for people in his place of power couldn’t be more correct.

On a side note, he coined the term “crypto patriot”. I’d like to submit this to the record as a new means to describe those that support financial freedom.

crypto patriot - noun

Definition of crypto patriot

: one who loves and supports financial freedom

// “Satoshi was praised as a motivated crypto patriot who was fearless in the quest to preserve financial security.”

Politicians may have woken up to the game China’s been playing for years. The monetary power they employ so liberally for both domestic and international policy is being threatened as China, Libra and permissionless networks develop.

A letter was sent by two US Senators directed at the executives of a few Libra Association partners at the time: Stripe, Mastercard and Visa. You can read the several page letter in full here.

“If you take this on, you can expect a high level of scrutiny from regulators not only on Libra-related activities, but on all payment activities.”

That doesn’t sound like a very democratic means of legislating any American company. Instead of applying pressure to the company's dealings with the Libra association, they went further by encompassing their entire business dealings that are separate from Libra. It was sent under the guise of protecting American citizens, but this thinly-veiled threat accomplishes nothing but bypassing the rule of law and stifling the ability to innovate.

Between the letter and showboating to grab the best soundbites in the hearing last week, Congress acts like a cornered animal. But if this is all just really a game of control, why should the United States even be playing in the first place?

Increased freedom is supposedly the end goal for U.S. legislators. Now’s the time to prove it. Refuse to play this game of escalating control and influence. The only winning move for the average citizen’s freedom involves Congress dropping this power play and allowing Facebook to create their own currency within the frameworks of established legislation while simultaneously supporting permissionless networks.

Does that mean Libra will have to be issued as a security or reduce its scope to that of a purely dollar backed stablecoin? That’s up to regulators, not just a few Senators writing a threatening letter or politicians fighting for the best “gotcha” moments.

To quote Zuckerberg once more, “If we can’t innovate here, someone else in another country will.” Even if he means this in the context of Libra, it rings just as true for the ecosystem surrounding bitcoin and all other digital currencies. If innovation is kept offshore, there’s no guarantee that the technologies being developed will be anything more than just extensions of authoritative governments.

Now Back To China.

Let’s dive into what China’s sudden positive turn on “blockchain technology and innovation” could include. Make no mistake here. As exciting as the news was to many people, they’re not promoting a permissionless and open-source tool for freedom. Consider the priorities and past actions of the Communist Party of China before jumping to conclusions. It's safe to expect that this digital currency, along with the use of blockchain technology, will take the cypherpunk ideals of bitcoin and removes the “punk” aspect while keeping the financial privacy for themselves.

It may be news to some, but at the end of the day, the term “blockchain” in the literal sense just means a “chain of blocks”, a list of records, called “blocks”- quite similar to that of a spreadsheet. The pages of this spreadsheet are cryptographically linked together, one after another. This concept goes back nearly thirty years in cryptography and computer science, but the term and technology have been made popular recently due to the way the Bitcoin Network has emerged. A ledger is not interesting in and of itself. What makes bitcoin’s ledger unique is that no single entity controls how or what transactions are recorded in the structure. Strip away the permissionless nature of the system, in which anyone can access and innovate upon, and you’re left with China’s digital currency. In other words, just an excel spreadsheet.

The blockchain based stablecoin, like the one described by Chinese officials, is nothing more than a backend upgrade for the government, albeit quite a large one. Goals you would expect from any government, like tax enforcement and censorship, become much easier with the ability to shut-off access to anyone on the system with a “flip of a switch”.

Traditional fiat currencies may already be mostly virtual and pretty easy to control, but there are still numerous databases that transactions are spread across. A digital currency would centralize, ironically, all transactions ever completed in the economy to a single ledger.

Fiat is currently transferred throughout a network of payment processors and application databases that effectively become barriers to an efficient surveillance and censorship state. While we see people deplatformed across the world everyday, there are limitations to the effect of that power. Digital currencies issued on a single database, possibly a blockchain structure, eliminates this problem. It’s a more perfect means of storing data that allows sophisticated tracking tools to control transactions and ultimately social behaviors, a 21st century authoritative government’s dream.

Pair this advancement with China’s growing ranking system that monitors the behavior of its 1.3 billion citizens based on their "social credit”. The future doesn’t exactly look bright with a system that’s meant to reinforce the idea of "keeping trust is glorious and breaking trust is disgraceful”.

Earlier this year, China banned 23 million citizens from buying basic travel tickets due to their low score. To quote the same document as before, the goal is to “allow the trustworthy to roam everywhere under heaven while making it hard for the discredited to take a single step.”

“By 2020, China’s rulers aim to implement an Orwellian system premised on controlling virtually every facet of human life—the so-called ‘social credit score.

- U.S. Vice President Mike Pence

Blockchain-based digital currencies are no doubt part of that “blueprint” Pence is referring to. It may have even been the missing piece.

Bitcoin Could Be Our Only Hope.

Governments have, with the announcement of blockchain technology support, sped up the learning curve for permissionless cryptocurrencies. As we saw in Venezuela last year, the government tried to introduce its own blockchain-based digital currency, the Petro. The only thing it managed to accomplish was increased governmental oversight while pushing bitcoin trading volume to all-time highs.

China should no doubt succeed where Venezuela failed. It will, however, have the same unintended consequence of educating its citizens about cryptocurrencies.

This goes further than just ideas spreading like a virus throughout the population. It comes down to how these systems are designed. Any national stablecoin may be more stable in its short-term price than bitcoin. Longer term it will encounter the exact same fundamental risks that every fiat currency in history has experienced: the management of monetary policy by a central party, whether that’s the Federal Reserve, Libra Association or the People's Bank of China. They continually make small trade-offs to maintain short-term stability, creating a never-ending supply of the currency and manipulating interest rates. It all interferes with the economic calculations done by the millions, if not billions of market participants.

More elegantly put by Saifedean Ammous in The Bitcoin Standard:

“Central planning of credit markets must fail because it destroys markets’ mechanisms for price-discovery providing market participants with the accurate signals and incentives to manage their consumption and production”

Nassim Nicholas Taleb describes this fragility using the phenomenon of preventing small forest fires at every opportunity to maintain the short-term stability of the wilderness. Only, after preventing these smaller burns from happening, you have now created a massive underbrush of kindling that will inevitably catch a spark and burn everything in its path.

Long-term economic risks become amplified in the eyes of investors under governmental jurisdictions that may have a history of encroaching on property and privacy rights. We have already seen a suppression of bitcoin exchanges, offerings, trading and mining within China. It indicates the government has found the amount of capital moving into a sovereign store-of-value quite alarming.

We learned that “roughly $2 billion of bitcoin moved out of China in 2016." This was the most recent data point available. I’d be interested to see how this number has climbed, no doubt, as the bull market the following year accelerated the pace of innovation and interest far beyond what we saw that year.

We can take what we know of traditional capital flights today as an example. "An estimated 400 to 600 tonnes of gold are snuck every year across the border from mainland China to Hong Kong in car boots and delivery vans, most of it in kilobars" That’s only a single sample size in the world's second largest economy. There’s countless other means investors use for capital flight. It’s attributed mainly to capital controls existing for citizens. This restriction includes an allowance of $50,000 per year and possibly even more tightening in the near future. Just like most things in life, those in positions of power and wealth have ways to circumvent rules. Buying expensive foreign real estate, and investments as examples are the primary outlets of capital flows.

Now imagine a means to store wealth outside the system of governmental control that’s within the average citizens reach - a type of gold that weighs nothing, takes up no space, and can't be counterfeited or seized. It teleports instantaneously anywhere in the world and no one can stop it from happening. You can verify with perfect certainty the amount in the entire universe, and how much of the total supply you own yourself for less than $100 of hardware and an internet connection.

That’s going to sound like science fiction to most people in the world, but it’s what bitcoin offers. Bitcoin opened up pandora's box of what’s possible. An even more recent example would be to look at bitcoin trading volume in Hong Kong. In August, activists began calling for a run on Chinese banks, asking that everyone withdraw their money on the same day. Since then, banks have been a focus for maximum disruption by activists. Reportedly, 10% of ATMs became so damaged at one point that they were not even functional, with another 5% of them running out of cash. A few weeks later, the Hong Kong government invoked emergency powers, a.k.a martial law, for the first time in fifty years to stop the protestors. It gave the government power to seize property, arrest citizens and completely shut down internet access at will. The powers have also been leveraged to ban the use of face masks in public settings. Likely this was to facilitate facial recognition and tracking software.

To give you an idea of the aggravation towards the system many are feeling, a JPMorgan Chase private banker was punched outside the company’s main Hong Kong office by a protestor. Citizens can only be pushed only so far before there’s an exodus of not just capital, but now four in 10 Hongkongers want to move to a different country, according to a new university survey - that’s a 10% jump from last year.

While all of these events were transpiring, local bitcoin trading volume made a new high by jumping from $3 million to $12 million.

This may be a small sample size but it has been a good measure of overall bitcoin volume in previous examples. It’s clear that many see bitcoin as a means to take a different approach to sovereignty. Bitcoin isn’t a get-rich-quick scheme, it’s a get-free-quick scheme.

Possibly the greatest and most relevant example of a permissionless network conquering that of a permissioned one is the internet vs intranet. Once the internet was born, banks and corporations built their own intranets, or permissioned networks. Entire corporate structures were using only the intranet in their day-to-day businesses. Clearly it was never a real competition in the long-term as we all use the internet today.

Millions of developers and users had the ability to innovate upon the internet’s base protocol. While corporations wanted to maintain control of their own systems, the internet's benefits quickly became too large to ignore.

The swap and onboarding of companies to the internet was quick. Everything had already been updated from paper to the digital intranet. Not only were backend systems already upgraded to using an interconnected system, the knowledge base of its users was already present thanks to the intranet onboarding years before. Workers had time to familiarize themselves and become accustomed to the intranets digital qualities. It only took a simple swap from the already digital permissioned network to the permissionless network of the internet.

History doesn't repeat itself but it often rhymes. We’re seeing this phenomenon of internet vs intranet play out in real-time, only now with bitcoin and stablecoins.

What if China Just Bans Bitcoin?

If the Chinese government were to ban bitcoin, the drug trade would have competition for the title of world's largest black market. Illicit drugs are a massive, if not the largest piece of a black market that operates across the world stage. The growing, processing and selling of physical material coupled with the severity of punishments ranging from monetary fines to death across jurisdictions, have not stopped the industry. If governments have been this inept at stopping something in a physical form from being transferred, good luck to them stopping something purely digital and permissionless to use.

In societies experiencing the tightening of governmental control over property and market dynamics, only the most resistant to those forces will survive. Like that of a “superbug”bacteria that’s resistant to antibiotics, bitcoin has evolved as the most resilient to state attacks of property, privacy and freedom.

Individuals are repeatedly besieged by their growing governments. Technology has managed to evolve into an organism that protects individuals from those very same attacks they’ve been repeatedly subjected to. Like a bacteria that’s been dosed with every antibiotic in the medical toolset, one cell will alter itself in an advantageous way. It’s a matter of “when”, not “if”. It’s a Darwinian-style, survival-of-the-fittest adaptation that facilitates its survival. This superbug doesn’t stop though, it passes along it’s newly found resistance to "unprotected" cells by transferring their beneficial genes, or in bitcoin’s case, onboarding new users.

The Idea of Freedom, Hidden in Plain Sight.

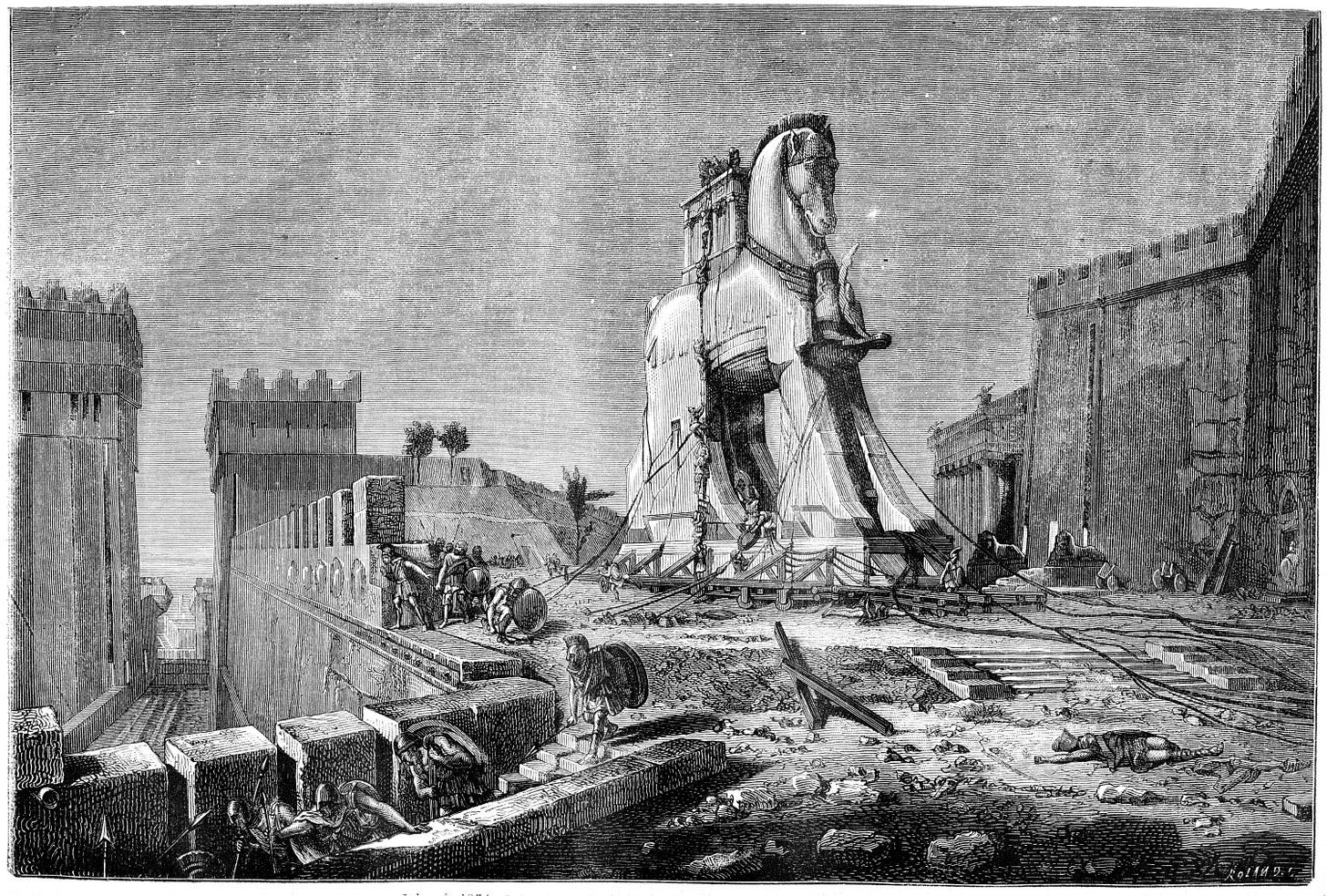

What makes all of this new found blockchain support from the Chinese governing party interesting is the possibility of a “Trojan Horse” idea of freedom. For those unfamiliar with the story, during the Trojan War the Greeks found themselves unable to take a city by brute force strength. They used the cunning plan of creating a giant wooden horse as a gift to the city they wished to conquer. Hiding within it were armed Greek soldiers. Once the “gift” bypassed the gates, they waited until nightfall and took the enemy by surprise from within.

President Xi, and every other government supporting “blockchain” technology will eventually come to realize bitcoin was hiding within it. The word “blockchain” has become so intertwined with “bitcoin”, that many interchange them both. While that may be incorrect to say, that doesn’t change this underlying notation of blockchain being leveraged for financial freedom the last decade through bitcoin. It has the potential to act as a trojan horse, fooling those that seek to adopt the underlying technology for their own gain.

The rise of the digital world has made it harder than ever to stop the flow of ideas.

They easily spread like a windblown wildfire.

Look at how punk culture and anti-establishment ideals are prevalent everywhere in the world where authoritarianism rules. Rebellion fills a primal need to push back. Even within the most oppressive regimes, if you look hard enough, you’ll find those that seek freedom through any means necessary.

There are millions, and eventually billions of people using and growing more acquainted with blockchain technology. Just imagine how many bitcoin and permissionless blockchain developers will be unknowingly trained by the government when creating and maintaining it’s centralized blockchain solution.

What’s to stop individuals from putting the “punk” back into “cypherpunk”?