The 11th year anniversary of Bitcoin’s white paper release has now come and passed. It was nine-pages, published anonymously by the pseudonym Satoshi Nakomoto in the wake of the financial crisis that plagued the world and plunged the global economy into a recession.

Many consider Bitcoin’s current price as a reflection of the value that this network has brought to the world. In an ideal situation, that would be accurate. Unfortunately, the situation Bitcoin is in, along with what it’s up against, is far from ideal.

Bitcoin's value increases steadily over time, while Bitcoin's price attempts to find it.

- Erik Vorhees

If you’re seeking to determine Bitcoin’s value progression, it may be useful to first consider the seven network effects that have been expanding since the network’s inception along with factors that may be suppressing the asset’s current pricing.

The following is not about quantifying Bitcoin’s price or value in numerical terms. The goal is, instead, to provide an outline placing the progress of Bitcoin’s major seven network effects into perspective.

Bitcoin’s Seven Network Effects

First introduced by Trace Mayer, one of the longest standing bitcoin investors, the seven network effects helps us further understand Bitcoin’s progression as a world reserve asset. The network effects for Bitcoin encompass the ecosystem as a whole, with a summation of multiple sectors that surround bitcoin starting first as a speculative asset.

Speculation

For some, bitcoin is a means to subvert governmental control. For others, bitcoin is a means to store value. For most, bitcoin is a means to make a short-term value gain. No matter how it's used, everyone benefits from the network effect and increased liquidity.

Speculation over Bitcoin's value has intensified to the extent that the Chairman of the Federal Reserve Jerome Powell, who is arguably the most influential man in the world's financial system, has offered input on the matter. Testifying before the Senate Banking Committee on Facebook’s Libra currency, he was asked:

If a cryptocurrency system became prevalent throughout the globe, would that diminish or remove the need for a reserve currency?

Powell replied:

Things like that are possible, but we really haven't seen them, we haven't seen widespread adoption. Bitcoin is a good example. Really almost no one uses bitcoin for payments — they use it as an alternative to gold. It's a store of value, a speculative store of value, like gold.

The fact that the Chairman of the Federal Reserve is joining the debate about Bitcoin's role in the system only adds weight to the theory that Bitcoin is a safe haven option for speculative investors. The insight provided by Powell alone lends major support towards the legitimization of Bitcoin's value, which has proven to be a difficult concept to convey to a generation that grew up in a vastly analog world.

Powell compared Bitcoin to the gold market - a market perceived as stable, that has grown steadily over the course of human civilization. With over 5000 years of price discovery, gold has been a store-of-value for possibly one of the most prosperous periods in history. Comparing an asset of that caliber to Bitcoin, a network with open-source technology created only a decade ago by an anonymous programmer, truly speaks to the potential of Bitcoin in the long term.

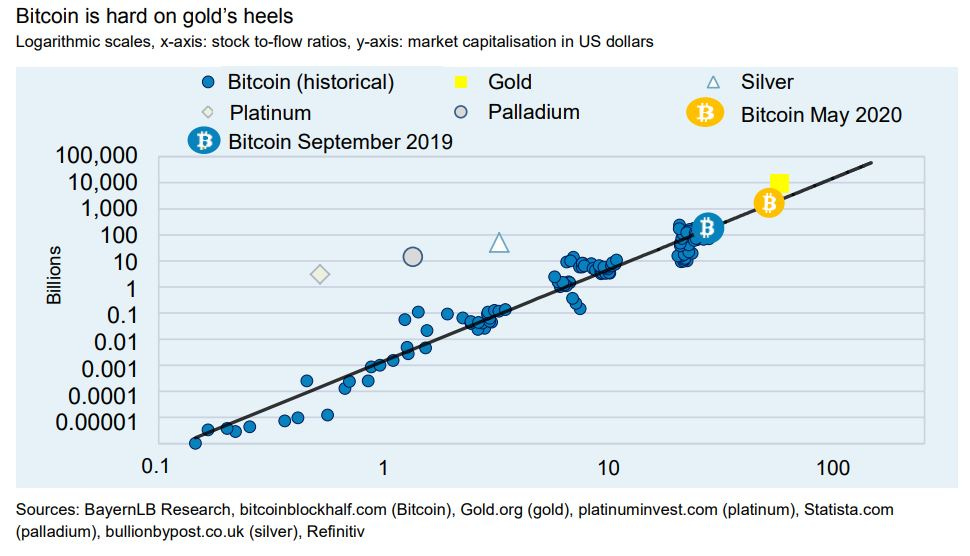

Months later, one of the largest, state-owned German banks, BayernLB, published a paper unrelated to Powell’s comments, but reinforcing the notion of Bitcoin being a store-of-value like gold. The conclusion the analysts reached was that of bitcoin being "designed as an ultra-hard type of money". The report suggests that the approaching Bitcoin halving effect is yet to be factored into its current price, citing the work of PlanB’s stock-to-flow model, which is a piece of data analysis that I would recommend any bitcoin speculator to absorb here.

The German bank went on to explain that gold had to earn its high stock-to-flow ratio “the hard way over the course of millennia.” Bitcoin on the other hand will most likely succeed in obtaining a similar stock-to-flow ratio to that of gold in the coming year, the report predicts.

If you’re unfamiliar with stock-to-flow, Saifedean Ammous explains it simply:

For any consumable commodity [..] doubling of output will dwarf any existing stockpiles, bringing the price crashing down and hurting the holders. For gold, a price spike that causes a doubling of annual production will be insignificant, increasing stockpiles by 3% rather than 1.5%.

It is this consistently low rate of supply of gold that is the fundamental reason it has maintained its monetary role throughout human history.

The high stock-to-flow ratio of gold makes it the commodity with the lowest price elasticity of supply.

The existing stockpiles of Bitcoin in 2017 were around 25 times larger than the new coins produced in 2017. This is still less than half of the ratio for gold, but around the year 2022, Bitcoin's stock-to-flow ratio will overtake that of gold

Back to the report, in which it concludes by saying that the Bitcoin's stock-to-flow ratio is certain to substantially increase in May 2020, adding:

If the May 2020 stock-to-flow ratio for Bitcoin is factored into the model, a vertiginous price of around USD 90,000 emerges. This would imply that the forthcoming halving effect has hardly been priced into the current Bitcoin price of approximately USD 8,000.

This is a reputable financial institutions in Germany, and it has legitimized bitcoin’s value proposition to its clients as an asset like that of gold. BayernLB isn’t a private bank that acts solely to its profits; it's a "Anstalt des öffentlichen Rechtes" which means it’s an institution “entrusted with a public task whose duties have been legally or statutorily assigned to it”.

It’s debatable how many speculators act upon these headlines and analyses. However, on a recent episode of Stephan Livera’s podcast, Raoul Pal, the CEO of Real Vision and a Global Macro Investor, was asked:

What does it take for more of the macro fund investors to come and be drawn into Bitcoin? Is it just a time factor? Is it that we’re already seeing that now?

Raoul Pal responded,

I don’t know anybody who isn’t in it.

If the last few years has taught us anything, it’s that you can’t stereotype the average bitcoin speculator. From macro investors getting exposure before their institutions have the legal red tape removed, to individuals in countries experiencing hyperinflation, Bitcoin’s network isn’t limited by imaginary borders and jurisdictions put in place by governments. Education and awareness of the asset has increased almost universally in the world, most notably with those in unstable economic situations, who predict that bitcoin’s safe haven qualities will increase.

In countries experiencing this turbulence, a trend is rising in peer to peer bitcoin trading volume via LocalBitcoins and even a premium on the purchasing of bitcoin against these local currencies. After the Argentine peso dropped heavily on the region’s election day, bitcoin began trading as high as $12,000 on LocalBitcoins.com, or 10% higher than on most international focused crypto exchanges. It wasn’t long until we saw this trend play out once more, this time in Hong Kong with government protests heating up. Bitcoin began trading at a 4% premium and increased volume.

All of these speculators have produced a thriving network of exchanges, wallets and service providers tailored specifically to bitcoin. An industry in-and-of-itself has been built to accommodate those that buy, sell and hold bitcoin. Just look at the companies that match buyers and sellers:

Coinbase raised $300 million in a Series E round, bringing its valuation to $8 billion while bitcoin was deep in a bear market

Kraken is valued at $4 billion while keeping its fundraising private

Bitfinex managed to hold a $1 billion Initial Public Offering

Binance brought in $446 million in profits in 2018 despite the bear market

This is a massive amount of value along with resources dedicated to the continued success of Bitcoin as an asset and network.

Merchant Adoption

While there may be some time before hodlers will want to part with their bitcoin, the number of those that will accept bitcoin in return for goods and services has grown.

The CEO of Square, Jack Dorsey, recognized the impact that introducing Bitcoin support had on the company’s Cash App revenue.

At the time, Square’s latest shareholder letter had revealed that their Cash App had taken in $135 million in subscriptions, services and transaction-based revenue — and Bitcoin revenue alone accounted for the vast majority of this total, bringing in a staggering $125 million.

The announcement also included support to the open-source bitcoin project BTCPay Foundation. Square decided to give the BTCPay Foundation a grant of $100,000 to support BTCPay Server, saying:

BTCPay represents everything we love about open-source bitcoin projects. It exemplifies the ideals of our community and promotes adoption by letting merchants accept bitcoin, control their private keys, and self-validate their coins. It also creates powerful real world applications for bitcoin without sacrificing user experience or requiring trusted third parties.

Even the owners of the New York Stock Exchange, ICE, are getting involved in the merchant network with their new platform Bakkt. Just announced, it will allow retail customers to purchase from Starbucks with bitcoin. Bakkt solves the age old criticism of bitcoin, “You can’t buy coffee with bitcoin”.

Consumer Adoption

At one point, more bitcoin merchants seemed to exist than consumers. The average consumer has shown that they’re incentivised to spend more of their paper money than bitcoin in day-to-day purchases. Though the market has found ways to adapt to this dynamic. As an example, when shopping online, users of services like Lolli, can earn bitcoin when spending their fiat currency. Consumers want to consume their fiat and receive part of their return in a more sound money.

At this point in bitcoin’s progression towards that of a reserve currency, many look at its previous price history and choose to hold and speculate instead of spending to consume. This will likely be a slow shift as price’s volatilty begins to drop, which we have already seen in magnitudes.

Security

To summarize the security network effect and repeating cycle:

The price of bitcoin rises.

Mining becomes more profitable due to the increased price of bitcoin received from the mining reward for producing the next block.

The hashrate goes up as more miners join the network to compete for this increased reward and in the process contribute their electrical power.

Network security follows hash rate’s growth as the increased amount of electricity spent creating blocks means more electricity is required to override the previous blocks.

With more network security from the increased difficulty of overriding previous blocks, comes more trust in the network’s ability to preserve the coins of the holders, leading to an increase in network usage.

The cycle repeats as these new users as well as increased trust in network lead to an increase in the overall use and subsequent price of the asset.

Bitcoin's hash rate is over seven times larger than it was during the peak of its historic price climb at an all-time high in late 2017. We're seeing resources being spent researching, developing, and deploying mining hardware at a record pace.

Bitcoin’s hash rate is important because it measures how secure the network is. The higher the hash rate, the more computing power is needed to compromise it. Bitcoin’s hash rate recently reached a record high of 108 million terahashes per second. Bitcoin is far and away the largest computational network ever created, and the most secure blockchain. This means controlling a majority of that computing power requires an enormous amount of computer hardware — hardware that would cost over $4 billion to buy outright. And even if someone happened to have a few billion burning a hole in their pocket, the costs to acquire, store, and power that hardware would be exorbitant. - Coinbase

Developer Mindshare

If you’re not bullish on Bitcoin, you’re likely not following the right developers. Be it on Twitter, GitHub or written work, it’s evident bitcoin developers work in a meticulous and deliberate way. Bitcoin is an open-source and permissionless protocol, meaning anyone can submit and run their own code. Whether or not other members on the network decide your code is worth accepting and running, is another story.

Many make the mistake of perceiving bitcoin’s focus on security as sluggishness, if not unwillingness to innovate. The Silicon Valley montra of “Move fast and break things” doesn’t exactly work well for money. As Jimmy Song, a bitcoin developer and teacher, has said, “Bitcoin is more of a monetary play than technology play”. That means security is key and the review of bitcoin’s new code improvements take time. If you’re storing wealth using this network, wouldn’t you want as many eyes as possible to overlook every addition to the underlying code base?

For a monetary play, bitcoin is innovating at the speed of...lightning!

Lightning Network - A “second layer” solution to scaling and privacy for bitcoin transactions. It allows for instant payments, extremely low costs and the possibility to even outscale traditional fiat payment processors. Being a layer built upon bitcoin, it does not interfere with the base protocol’s security. The idea is that not all transactions are required to be recorded on the Blockchain, keeping that of a bar tab open between nodes and only settling on-chain when the “channel” is closed.

Segwit - A soft fork upgrade to bitcoin that enables the technology allowing Lightning Network to function as a second layer scaling solution. It also fixed an issue called transaction malleability, which enabled BTC transaction data to be changed before the network processed these transactions. This upgrade was also used to increase the block size to accommodate more transactions throughput.

Schnorr - Recently freed from a patent, Schnoor is leveraged to increase on-chain privacy by aggregating multiple signatures and their corresponding keys into a single transaction. Without Schnorr, a commonly used type of transaction like MultiSig is easy to detect as you have multiple keys and signatures. With Schnorr, those become a single transaction obfuscating the tell-tale signs of what an individual may be leveraging the blockchain for.

Sidechains, MAST, Taproot, Graftroot, RSK, and RGB are just some of the other innovations being done around bitcoin. Together, these projects demonstrait the substantial developer mindshare focused on bitcoin’s continued success. The more innovation bitcoin is subjected to, the harder it becomes for other assets to outcompete bitcoin in this network effect.

Financialization

“Financialization” is the inevitable process of Wall Street getting control of bitcoin. That’s only a joke, of course. Financialization is when the value between multiple parties is facilitated using a financial instrument - this includes derivatives like futures and options.

Nothing is inherently negative about the process, although the selective timing of additions to the ecosystem could be argued against. As it turns out, The Trump administration acted to deflate the bitcoin bubble of 2017 by allowing the introduction of futures products. Christopher Giancarlo, the Chairman of the U.S Commodity Futures Trading Commission at the time recently said:

“One of the untold stories of the past few years is that the CFTC, the Treasury, the SEC and the [National Economic Council] director at the time, Gary Cohn, believed that the launch of bitcoin futures would have the impact of popping the bitcoin bubble. And it worked.”

This leaves critics of bitcoin’s financialization with a mildly stronger claim that these products only serve to complicate the market which requires a skill set out of reach for most market participants. Bitcoin is the first time the average person has had a head-start on Wall Street, and many don’t want to give that up. But as a permissionless network, you can’t stop anyone from building upon it. Ultimately, if bitcoin can be stopped by some person in a suit shorting the market, the project was doomed to fail from the beginning.

Increased complication can conceal when bitcoin is created ‘out of thin-air’ if not auditing the onchain metrics. Rehypothecation, or creating more claims to the bitcoin than there are bitcoin is likely already happening. Arguing whether or not this is a negative development is a mute topic, as it will continue. What’s clear is that the market participants need to be aware of this inevitable process and leverage the audibility of the Bitcoin Network to maintain confidence.

For all the negative connotations that this evolution of bitcoin’s market may carry, it’s important to remember what makes money useful in the first place. Bitcoin is money after all. What we use as money today is the most liquid asset we have available, the US dollar. Liquidity refers to the ability to buy and sell other goods easily with the asset you’re using as money. Anything could really constitute as money if you own something only for the reason of trading it for something else in the future. A baseball card, for instance, could be called money, but is it good money? As the old phrase goes, cash is king, meaning liquidity is king. It’s only useful as money if you know someone else is willing to take your asset in exchange for what you want in the future.

If bitcoin is really going after the king of liquidity, the US Dollar, financialization of bitcoin is necessary. As more rails to the market are created, it’s giving the green light to those who need services to legally get financially involved in the bitcoin space. This new wave of institutions and investors exponentially increase the other network effects of bitcoin. Speculation is the ultimate cause of financialization, as many had been previously handcuffed by bitcoin’s unregulated environment and lack of services. The more speculation, the more liquidity will naturally become available.

What progress has bitcoin made in it’s financialization, though? Like mentioned above, investors can now hedge Bitcoin with a futures product developed by the leading and largest derivatives marketplace: the CME Group. Even before the recent 40% spike in bitcoin’s price, the exchange averaged $515 million of daily volume in May of this year.

As this network effect grows, it seems that even a bitcoin ETF may become available to investors within the next year or so. With that comes the benefit of more valid pricing and higher liquidity for bitcoin, both of which are required for a world reserve asset to flourish.

“We’re closer than we’ve ever been” to bitcoin ETF approval, says Bitwise head of research.

This statement is a bit dated with futures volume climbing the last few months as the market has been heating up, but he also went on to say:

Two years ago, there were no regulated, insured custodians in the bitcoin market. Today, ... there are big names like Fidelity and CoinBase [with] hundreds of millions of dollars of insurance from firms like Lloyd’s of London,

Two years ago, there were no regulated crypto exchanges. Now, six of the 10 big crypto exchanges are regulated by the New York Department of State with market surveillance technologies in place. And, most importantly, two years ago, it was a one-sided, inefficient market. Today, we have $200-plus million in volume and regulated futures every day.

Missing from this analysis are the owners of the New York Stock Exchange jumping head first into the bitcoin ecosystem with the launch of their physically delivered futures product, Bakkt. The first few weeks may have been a slow start for the platform, but it quickly began making new volume highs, reaching 1,179 Bitcoin futures contracts facilitated in a single day.

Adoption as a World Reserve Currency

All six other network effects feed into this overarching development in bitcoin’s growth as an asset. The history of money and our understanding of its network effect leads us to believe that the reserve currency is a “winner-take-all” competition. This generally means there can only be one dominant reserve currency at a time.

In less than a decade, bitcoin has managed to grow to be within the largest 30 currencies in the world ranked by market cap. Ranking instead by global monetary base, bitcoin is currently the 11th largest currency in the world, including gold and silver, and 9th if both where to be excluded. This puts bitcoin firmly on the macro landscape for the title of World’s Reserve Currency.

A single satoshi, bitcoin’s smallest denomination equaling 0.00000001 BTC is already larger than some national currencies issued by governments, including:

Iranian Rial

Vietnamese Dong

Indonesian Rupiah

Guinean Franc

Sierra Leonean Leone

Laotian Kip

Uzbekistani Som

Venezuelan Bolivar

Bitcoin has grown so much within the last half a decade that even the President of the United States has taken notice. In a fiery tweet storm, he speaks as if bitcoin is a rival to the U.S Dollar while downplaying its usefulness.

The message couldn’t be clearer. The power that the United States has in issuing the world reserve currency is under attack. Within the last few months, we have now seen the President, several Members of Congress, and Secretary of the Treasury publicly criticize bitcoin while advocating for their own currency for reserve status. It’s hard to blame them, as the Federal Reserve chairman says,”the United States is not running a sustainable fiscal policy” and “the dollar will not be reserve currency forever”.

Not to bash the competition much further, but the U.S dollar is under attack not just by outsiders, but the President himself. He recently called the Federal Reserve an enemy, and compared them to an authoritarian regime.

Not everyone in the American government has such a confrontational view towards bitcoin however. As the whitepaper turned eleven years old, two members of Congress separately tweeted out a congratulations to making it this far:

There’s more here to be said than just opinions from world leaders, as new reports have recently been revealed. Venezuela’s central bank is actively planning to accumulate a reserve holding of bitcoin and manage the custody security within its existing infrastructure. “Four people with direct knowledge of the matter” have detailed a request made by Venezuela's national oil company, one of the largest in the world, to pay the central bank in actual bitcoin. This company is a major source of income for the nation, and they want to pay with bitcoin.

While it’s unclear how much Bitcoin the country is holding, it has the possibility to be substantial as the government has been actively monitoring and licensing exchanges, and even overseeing mining operations across the country. There’s been a history of officials confiscating mining hardware as well.

We know North Korea, Iran and possibly even Russia could now be holding bitcoin, and/or at least the capability of it.

The first individuals using bitcoin were attempting to avoid sanctions on drugs, while the first nations using bitcoin are attempting to avoid sanctions on everything but drugs.

Factors Suppressing Price

Barriers to Entry

While it may be true that the Bitcoin ecosystem is much more accessible than it was even just a few years ago, the challenge still remains for beginners to understand enough to get exposure. They have to take the time to educate themselves on what Bitcoin actually is, which we all know is a bit of a “rabbit hole” in which you can quickly become overwhelmed with talks of private keys, hashrate, nodes, and of course that of Bitcoin vs Altcoins. We take the knowledge we’ve acquired for granted when saying, “Bitcoin is as easy as just buying some from an exchange”. Well then, “What about Bitcoin Cash?” You get the point, it’s a sharp learning curve unlike assets that many more are familiar with.

Once that user makes it past the initial stage, they’re thrown into what appears as a lawless, Wild West of exchanges, wallets, and service providers.

The user experience of even the top exchanges in the space have had countless issues that shake the confidence in market participants. Hacks of various amounts of user funds and information happen periodically, as well as massive liquidations based on poor pricing mechanics becoming commonplace.

BitMEX, the go-to exchange for leveraged bitcoin trading just last week accidentally leaked the emails of a massive amount of its users. This potentially just doxxed the majority of their users in a way that could be detrimental. Being acknowledged as trading on a bitcoin exchange, let alone one with a lacking regulatory oversight compared to others, would at the very least be unwarranted attention.

If you were to take the list of just the most notable exchange hacks in recent memory, the list would quickly become too long to include within this post. In the first six months of 2019, there had already been seven crypto exchanges successfully hacked with millions of dollars worth of user funds lost.

Volatility Causes Hesitation

Most bitcoin investors understand the source of bitcoin volatility, though many in the mainstream do not. Judging bitcoin’s value based on its volatility is like judging a seven-year-old's future basketball career based on his current height. A reserve currency doesn’t gain that title overnight. The process entails a massive amount of value cycling in and out of the asset as it trends upwards.

Looking at the price or market cap of bitcoin you’re left with what detractors see as a story being told of tulip-mania, a pyramid of greater-fools, and a bubble rivaling that of the dot com era. It’s hard to argue when the chart follows that of most stereotypical bubble through-out history. Using a logarithmic chart, or looking at a more complete metric like that of the realized market cap of bitcoin, you see a more gradual climb. Arguably, both the barriers to entry and price volatility lead to the media headlines we are accustomed to seeing.

Mainstream Negativity

For the better part of bitcoin’s existence, the media coverage has been overwhelmingly negative. It could be argued that the media has suppressed the price of bitcoin to a degree. The amount, of course, is impossible to quantify but here are just some of the examples of early bitcoin obituaries the media pushed to their audiences:

“The Rise and Fall of Bitcoin” – Wired at $2.37

“So, That’s the End of Bitcoin Then” – Forbes at $15.15

“The SEC Shows Why Bitcoin Is Doomed” – Bloomberg at $93.57

“Bitcoin Sees the Grim Reaper” – NY Mag at $105.7

“Fool’s Gold” – Slate at $131.95

“Bitcoin revealed: a Ponzi scheme for redistributing wealth from one libertarian to another” – The Washington Post at $182.00

“Bitcoin Is a Victim of Disinflation” – The New York Times at $208.50

“Bitcoin is headed to the ‘ash heap'” – USA Today at $208.50

“Bitcoin’s upcoming capital crisis” – Financial Times at $290.51

“Bitcoin’s defects will hasten its demise in 2015” – Reuters at $327.20

“Can Bitcoin survive 2015?” – AOL at $332.63

“Where did Bitcoin go wrong?” – CNN at $333.58

“Bitcoin Is A Joke” – Business Insider at $433.57

For reference, Bitcoin’s price is currently over $9,000 and the network’s hashrate is over 90 exahash per second.

Media publications will post what gets them the most clicks. It shouldn’t be a surprise that fear-mongering bitcoin still continues to exist even almost a decade after these headlines were published. Excluding more recent quotes from the President of the United States and other world leaders, here are some past examples:

“The quest for decentralized trust has quickly become an environmental disaster” because of the electricity requirements, and “a cryptocurrency can simply stop functioning, resulting in a complete loss of value.” - Bank for International Settlements

“For many reasons the crypto-assets in your digital wallets are unlikely to be the future of money” - Governor, Bank of England

“Bitcoin is in no way a currency, or even a cryptocurrency. - Governor, Bank of France

“Cryptocurrencies like Bitcoin, we should be looking at these very seriously precisely because of the way they can be used, particularly by criminals,” - Therese May, U.K Prime Minister

“It is not a stable store of value, and it doesn't constitute legal tender,” - Janet Yellen, Federal Reserve Chair

“Bitcoin is an attempt to replace fiat currency and evade regulation and government intervention. I don’t think that’s going to be a success.” - Federal Reserve Chair, Ben Bernanke

There is hope that the media may take a turn in the reporting narrative regarding bitcoin. With so much positive news last year, it would be hard to ignore. One of the most influential leading media figures, Joe Kernen, a host on CNBC has been promoting bitcoin nearly relentlessly on air.

As a side note, I’d like to take partial credit for Joe’s quote that seemed to help shift his viewpoint towards Fiat, Libra and Bitcoin:

There’s no mistaking that the bitcoin ecosystem is plagued by: security vulnerabilities in services, price volatility, a steep knowledge learning curve and negative media coverage. It’s a difficult argument to make that price hasn’t been affected by any of these factors. The influx of new capital and users has likely been stymied, to a degree, by this combination of negative network effects.

Bitcoin’s price may have slowed in its progression upwards, but it has remained resilient as each of the seven positive network effects have grown considerably. The question comes down to, do you think this asset’s value is accurately priced at a sub $200 billion market cap with these seven network effects exponentially growing?