Bitcoin Is A Hedge Against Your Government

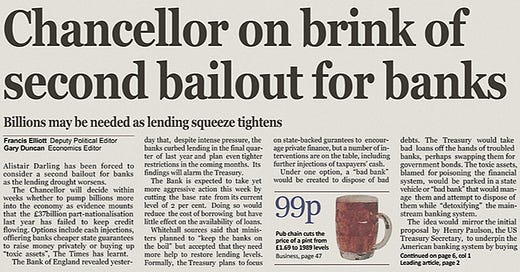

The news headline, "Chancellor on brink of second bailout for banks" was embedded into the genesis block of the Bitcoin Network. It does not matter who specifically added that, nor does it even matter that it was included at all. It could have just been a way to timestamp and prove the date the network was created. It is tempting to speculate though. The political statement is hard to miss. Banks being bailed out a second time, after the global financial crisis, could not be more direct. Its inclusion in the first block of Bitcoin transactions provides a reminder of what this system gives to its users — a way to challenge the status quo of central banking. Bitcoin is a way to opt out of the traditional legacy system that benefits the few in power of the monetary supply.

Price discovery is the largest objection to Bitcoin’s value proposition as an alternative and hedge to the financial structures the world is built upon today. Let us just get this part out of the way. Focusing on the details of the current volatility is missing the forest for the trees. By looking only at the individual trees, critics cannot see the bigger picture. Properties of the Bitcoin Network provide a new monetary foundation due to its decentralized and permissionless design. These characteristics protect users against the debasement of their wealth through inflation, encroachment of property rights, and suffocating financial surveillance. However volatile Bitcoin’s short-term price may be and however difficult the user experience still is, the value proposition of the system has proven itself effective over the course of a decade. Criticizing Bitcoin's future as a reserve currency and foundation for a new financial system, based on its current volatility is like judging a kindergartner's future NBA basketball career on the fact they are too short to make the team. A distinction and trade-off between Bitcoin’s short-term price and its long-term characteristics of the network needs to be made.

Any fiat currency, such as the dollar or euro may appear to be more stable in its short-term price than Bitcoin. Longer term, a system built upon fiat currency encounters the same underlying risks that every other structure in history has experienced: the management of monetary policy by a central party. When a person or group of people are put in charge of managing the issuance of a currency, they continually make small trade-offs to maintain short-term stability. They may issue more currency, manipulate interest rates or implement other capital controls. These seemingly small trade-offs interfere with the economic calculations done by the millions, if not billions of individual market participants. Incentives become misaligned when the signals everyone uses to adjust their consumption and production are not accurately displaying the market condition due to intervention.

Nassim Nicholas Taleb describes the fragility of a system that attempts to lower short-term volatility by using the phenomenon of preventing small forest fires at every opportunity to maintain the short-term stability of the wilderness. Only, after preventing these smaller burns from happening, what has been left is a massive underbrush of kindling that will inevitably catch a spark and burn everything in its path.

In contrast, Bitcoin’s free market may be more volatile in the short-term, but this allows the checks and balances of price discovery to play out. Bitcoin has proven that rules without rulers is not only possible, but effective. Without any single person manipulating or regulating fundamental functions, Bitcoin has:

Mined ~600,000 blocks

Enabled ~480,000,000 transactions

Rewarded ~18,000,000 coins to transaction validators

Produced ~100 exahashes per second

Absorbed ~$130 billion in value

Acquired ~$100 billion in average cost value

Secured ~10,000 full nodes validating the ledger

Achieved ~6,000 lightning nodes routing transactions

Maintained ~99.98% uptime since its inception

Created ~10 years of higher lows in price

The existence of a network as robust as Bitcoin without any central planning demonstrates in real-time an alternative method to the centralized foundation global finance relies on.

Trade-offs by governments and banks to reduce near-term volatility and prolong periods of economic expansion, comes at the cost of debt. While not fundamentally a negative result, small fires were put out as they came along, but the underbrush has been allowed to accumulate. Governments are left with only a few options when debt reaches a level where simple increases in revenue will not solve the problem. The most liberally used method to “solving” this debt issue is printing more of the nation’s currency, i.e causing inflation. In that way, as the debt is denominated in a specific amount of currency, and more currency circulates, the government’s debt is relatively reduced. This comes at the expense of purchasing power reductions.

While protections do exist against this phenomenon, they may not always be within the average citizen’s reach. Hedging oneself requires holding large amounts of a limited supply asset like gold, or a financial middleman to appropriate capital in a mixed portfolio of funds, stocks, bonds, cash, ETFs, real estate and other commodities. All current options come at a cost some can not afford. There is a need for a simple option - the value proposition of Bitcoin, a sovereign currency. Like gold, it is a store-of-value that can not be debased by a government — a type of gold that weighs nothing, takes up no space, and resistant to counterfeit or seizure. A user can verify with perfect certainty the total asset count in the entire universe, and how much of the total supply the holder owns themselves. It can be done for less than $100 of hardware and an internet connection. That may sound like science fiction to many, but it is what Bitcoin offers. Bitcoin has opened up pandora's box of what’s possible.

In societies experiencing inflation along with tightening of governmental control over property and market dynamics, only the most resistant to those forces will survive. Like that of a “superbug” bacteria that’s resistant to antibiotics, Bitcoin has evolved as the most resilient system to state attacks of property, privacy and freedom. Holding Bitcoin involves keeping a private key in the user’s possession. This is a fundamental change in the storage and protection of personal wealth. A private key is a list of phrases, be it 12 or 24 words. Storing those words are up to the holder, but it could even just be memorized. With Bitcoin, a user has a way to opt-out and hedge themselves against inflation and the pressure that governments, payment providers, and banks use to confiscate wealth. The only means of taking personal capital would be to acquire the user’s words and phrases in the correct order. Bitcoin’s security comes down to the user and there is an ever-growing amount of tools aimed at assisting them in safeguarding their own private keys.

With the pairing of economic unrest and simultaneous advances in technology, the world has managed the evolution of a new organism that protects individuals from those very same attacks they’ve been repeatedly subjected to. Like a bacteria that’s been dosed with every antibiotic in the medical toolset, one cell will eventually alter itself in an advantageous way. It is a Darwinian-style, survival-of-the-fittest adaptation that facilitates its effectiveness. This “superbug” thrives, passing along its newly found resistance to "unprotected" cells by transferring their beneficial genes, or in Bitcoin’s case, onboarding new users.

Bitcoin protects against even the more indirect ways of restricting individuals ability to transact and save their wealth. Physical cash has been used to preserve the privacy of its users for most, if not all of human history. When a dollar bill is handed to another person, no middle man exists. There is no record of the dollar bill moving from one hand to the other. That same concept has been brought into the digital world, albeit in a unique fashion, with Bitcoin. Bitcoin is a peer-to-peer digital cash. While sophisticated tracking software for transactions recorded on the Bitcoin Network exist, second layer solutions to the network vastly decrease their effectiveness. There are multiple implementations being built that give the users privacy while maintaining the security of the network itself.

Bitcoin preserves the benefits of cash-like privacy but for the digital age. Before Bitcoin’s creation, every single payment processed online had to go through the hands of a digital intermediary as the “double-spend” problem had not been solved. A trusted third party has been required to prevent the duplication of cash and maintain the ledger of all transactions as data can be copied and replicated. That problem has now been solved and proven viable during the last decade. Bitcoin may end up taking time to integrate into day-to-day lives, but a surveillance state is no longer inevitable in the digital age.

Due to the rise of the internet, and now partly due to Bitcoin, governments and central banks are beginning to issue their own digital currencies. This allows authorities more control over participants and users. These are not permissionless and open monetary networks like Bitcoin. They are closed systems that can only invite innovation with permission from the authority that issues them. Possibly the greatest and most relevant example of a permissionless network conquering that of a permissioned one is the internet vs intranet. Once the internet was born, banks and corporations built their own intranets or permissioned networks. Entire corporate structures were using only the intranet for their day-to-day business. It was never a real competition in the long-term as we all use and rely on the internet today.

Millions of developers and users had the ability to innovate upon the internet’s base protocol. While corporations wanted to maintain control of their own systems, the internet's benefits quickly became too large to ignore. The swap and onboarding of companies to the internet was quick. Everything had already been updated from paper to the digital intranet. Not only were backend systems upgraded to using an interconnected system, the knowledge base of its users already exists thanks to the intranet onboarding years before. Workers had time to familiarize themselves and become accustomed to the intranet’s digital qualities. It only took a simple swap from the already digital permissioned network to the permissionless network of the internet.

History doesn't repeat itself but it often rhymes. This phenomenon of internet vs intranet is playing out in real-time, only now with the open Bitcoin Network and the closed traditional financial system. Not having exposure to Bitcoin is in-and-of-itself an investment. It means that capital speculation is completely within the legacy permissioned financial system.

Choose wisely.