Bitcoin And The ‘Great Wealth Transfer’

Within the next few decades, Millennials will become the wealthiest generation in history and banks should be worried, if they’re not already. Millennials have started making a major shift towards the use of unconventional banking, with Bitcoin posed to be the beneficiary of the 'Great Wealth Transfer' of our time.

(Photo by David Shankbone)

This generation, set to be a critical determinant of the future of Bitcoin and other cryptocurrencies, is defined as the population born between 1981 and 1996 or those currently aged 22-37 years old. According to population projections from the U.S. Census Bureau, Millennials are about to surpass the wealthiest generation in history, the Baby Boomers, as the nation’s largest living adult generation, which is an important moment for one major reason: money. The Baby Boomers enjoyed a record long economic expansion resulting in a prosperous time for wealth accumulation. They are set to pass on a massive $68 trillion to their children, the largest generational wealth transfer ever (source).

The Silent Generation: Born 1928-1945 (73-90 years old)

Baby Boomers: Born 1946-1964 (54-72 years old)

Generation X: Born 1965-1980 (38-53 years old)

Millennials: Born 1981-1996 (22-37 years old)

Post-Millennials: Born 1997-Present (0-21 years old)

It is happening sooner than you may think. Disposable income for millennials is predicted to grow to over $7 trillion within the next decade and by 2030, they will hold five times as much wealth as they currently do (source).

With all that wealth, what are the Millennials going to do with it? It is simple, spend it or save it. But how are banks going to fit into this equation? The answer is not as simple as with previous generations, as there is clear mistrust in banks. According to the Millennial Disruption Index - a 3 year study of 10,000 Millennials, the majority (71%) of Millennials reported that they would rather go to the dentist than listen to anything banks have to say. This distrust is not entirely misplaced.

The earliest cutoff for the Millennial generation is 1981. Their lives and perceptions were defined by events in early 2000. At that time, they were both “old enough to have experienced and comprehend 9/11, while also finding their way through the 2008 recession as young adults” (source). The first decade of the millennia was plagued by instability. Banks were at the forefront.

The 2008 Global Financial Crisis was a wake up call for many generations, Millennials especially. The same, seemingly stable institutions that helped many achieve the “American Dream” of owning a home, car and starting a family, instead left millions in debt. Banks knew that much of that could never be paid back. The worst outcome of this greed is that the American taxpayers had to bail them out to prevent the entire system from collapsing.

The 2008 financial crisis was the worst financial disaster since the Great Depression, inflicting widespread, devastating costs on millions of American families,” said Ranking Member Waters. “All told, more than $13 trillion of household wealth vanished, 11 million individuals were displaced from their homes, and nine million Americans lost their jobs. (source)

Even the world’s largest brokerage, Merrill Lynch that had over $2.2 trillion in client assets, was not immune and collapsed almost overnight (only to be bailed out by a sale to Bank of America). If an institution could disappear in an instant and take the rest of the financial system with it, it is not much of a stretch to understand the apprehension of Millennials and trusting the same system.

Events do not have to be as dramatic as the collapse and bailout of Merrill Lynch to instill distrust. Wells Fargo was later caught red-handed opening 2 million deposit and credit accounts in customers’ names without their consent (source). These fake accounts were opened to help meet the bonus quotas at the firm. Wells Fargo’s response was to fight in court until they were forced to pay a slight fee, and then release this commercial almost a decade later:

We are sorry, we promise this time it is different.

But is it really different this time? Millennials have made it clear that any apology is not accepted. A Harvard study found only 14% of millennials trust Wall Street to do the right thing “all or most of the time.” Meanwhile, 83% of all Americans believe Wall Street is no more ethical today than it was in 2008.

A bank is a place where they lend you an umbrella in fair weather and ask for it back when it begins to rain. - Robert Frost

It is clear that conventional banking is far from a perfect insitution. There is simply too much risk in a Millennial trusting a system that has been shown to fail.

With past events highlighting the instability of banks, it is no surprise that Millennials are considering other forms of storing wealth. The majority (68%) of Millennials would strongly consider leaving their traditional banking relationships and swapping to a tech company’s digital banking and payment services - Facebook, Google, Apple and Amazon offerings. Quite a stark contrast with only 32% of Baby Boomers ready to make that same shift from their current banks (source).

That is not to say that all Millennials dislike their banks. Approximately half (53%) of them believe that nothing sets their personal bank apart from any other competing bank, according to a survey by Scratch. They are accepting this traditional system because seemingly, there are no other favorable choices.

Related to alternative banking options, while not as large as the four tech giants named above, PayPal’s Venmo app has 40 million users as of the first quarter of 2019 while Square’s Cash App boasts an impressive 15 million (source). It does not come as a surprise that a third of Millennials think they will not need a bank at all in the future.

This inherent distrust for institutions sets the stage for a new way of investing. According to a survey from eToro, Millennials trust cryptocurrency as an asset—at least, more than they do the stock market run by traditional Wall Street. The survey, commissioned by the independent research firm Provoke Insights, asked 1,000 online investors in the U.S., ages 20 through 65, about stock exchanges, cryptocurrency exchanges, and 401(k)s. Forty-three percent of millennial respondents said they trusted cryptocurrency exchanges more than U.S. stock exchanges.

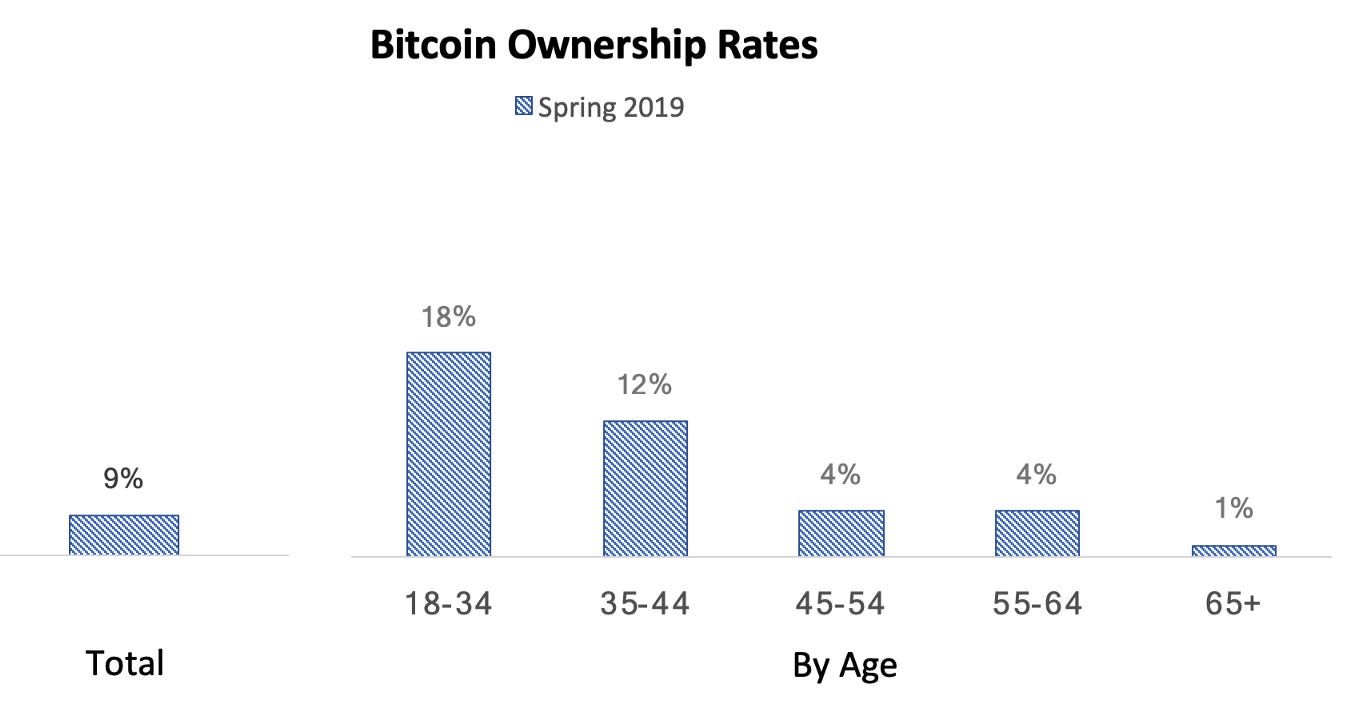

Putting trust aside, a portion of Millennials are currently making use of cryptocurrencies and more will likely follow in the future. A quarter (25%) of American Millennials, aged between 24 and 38, and earning $100,000 in individual or joint income, or owning $50,000 in investable assets, are either holding or using cryptocurrencies (source). Another 31% are interested in using cryptocurrencies. Lending the most support, a study was performed by Blockchain Capital which found that 9% of the population owns Bitcoin — including 18% of those aged 18–34 (source). Millennials are already opting for a system based on math and code versus that of legacy institutions. This margin almost doubles if not triples that of older generations.

The Millennials are a generation that was and still is being heavily influenced by technology. Since the beginning of this generation, there has been an exponential explosion in innovation. The majority likely grew up using both landlines and an iPhone. It was an incredible change from an analog to a digital world. “The world at your fingertips” is not just a slogan for AOL. The ability to have everything accessible online has shaped an entire generation for the first time in history. Millennials have a different set of behaviors and experiences than previous generations. It is an unprecedented digital upbringing. It has made it so difficult for leaders and institutions to see the world from their point of view. They came to age during a time of technological change, globalization and economic disruption.

Their ability to use, apply and understand different technologies quickly sets them apart from other generations. They were after all, the first to grow up surrounded by these digital technologies. This includes broadband internet, home computers, video games, social media, and smartphones. According to Pew Research Center, more than nine-in-ten Millennials (93%) own smartphones, compared with 90% of Gen Xers, 68% of Baby Boomers and 40% of the Silent Generation (source).

Millennials are already reshaping the economy. This includes new dynamics, a whole new reality, a fully digital reality. What is a more perfect example to highlight this generational shift than the surprising move from traditional sporting events to eSports, or competitive video gaming? The history of sports dates back to the BC era of civilization. It is also no surprise they are still wildly popular today. What is surprising though, is the rise of eSports, or at least to older generations. Millennials make up the vast majority of viewership with over a 73% share across the eSports industry.

It is important to recognize the scale that these video games and digital mediums have obtained in recent years. A major objection to Bitcoin’s value proposition is that it exists only in digital form, something intangible to most. Millenials are not concerned. If anything, it is a selling point of the asset.

eSports is the fastest growing sport category in the world. Last year, digital sporting events beat out nearly all physical competitions in viewership in the United States (source):

NFL : 141M

eSports: 84M

MLB: 79M

NBA: 63M

NHL: 32M

MLS: 16M

One of the most popular video games for spectators across the world is League of Legends. Every year, Riot Games, the creator, hosts a competition with teams from across the world. The semi-finals for this competition this year (2019) drew 4 million concurrent viewers, not including its enormous Chinese viewership (source).

eSports competitions are a global phenomenon. They are continuing to only gain traction. Last year, the championship match of this same competition had 200 million concurrent viewers in China, with additional millions in other countries. Only a decade ago, the founders of the game almost decided not to launch a sporting tournament. They believed there would be no demand for spectating video games. A thousand or so fans showed up to their first tournament in 2011 and now hundreds of millions of the younger generations tune in (source).

It does not stop at just spectating these video games. The games involve unique digital currencies. These are purely digital forms of money, whether it is coins or gold, earned through battle or trade; this “in-game currency” can then be exchanged for other goods or equipment. As a result, several generations are completely comfortable buying, selling and participating in transactions.

Initially, virtual currencies were completely internal to the game environment. Now many games have evolved to allow players to buy more ‘game money’ with their real-world cash. Once inside and participating, along with a virtual wallet stuffed, goods and services can be purchased.

Fortnite, a relatively new video game, brought in $2.4 billion in revenue last year. As amazing as that figure is, it is even more incredible knowing the game is completely free to play (source). But to purchase “in game” content, such as different outfits for your character, you need to trade your US dollars for the companies virtual currency. The vast majority of that company's revenue is from selling their own created virtual currency. Fortnite was not the only impressive entity last year selling game based currencies:

League of Legends - $1.4 billion

Arena of Valor in the West - $1.3 billion

Pokemon Go - $1.1 billion

Candy Crush Saga - $1 billion

We are in the digital age. Digital currencies are inevitable.

The step from virtual currency to cryptocurrency is smaller than many realize. Bitcoin shares many characteristics of money the younger generation has become accustomed to. Notice this simplified comparison between Bitcoin and banking:

To use bitcoin:

1. Download a wallet

2. Receive your funds

To use banks:

1. First travel to location during the banks operating hours, which ends up hardly align with a typical 9 AM to 5 PM job.

2. Present your identification card, which many may not even have as it costs time and resources, at least in the United States.

3. Give them your social security number which is vulnerable to identity theft due to the fact you are supposed to keep it for your entire life.

4. Get charged hidden fees because you do not meet the minimum deposit or any number of other factors.

5. Come up with an initial deposit amount to even open the account itself.

6. Show proof of address, and hopefully you have some previous bills to bring with you to the bank.

7. Try to read through tens if not hundreds of pages of legal documentation and sign away your rights to privacy and their liability if funds are lost.

8. Wait a week for your funds to get processed only to find out that the wire transfer someone sent you “got lost” and ended up just forgotten about until you called your bank a week later. Calling your bank was not enough though, you had to go in person to talk with a teller only to be told to call the bank’s wire department.

9. Be limited in where and how you can spend your newly accessed funds while having to trust the bank does not betray your trust.

To be fair, this description is a bit exaggerated. The example is only meant to highlight the differences Millennials have become accustomed to. Bitcoin is like that of the internet, giving instant feedback and is as borderless as the internet itself. Millennials expect on demand service to be only a click away, all without limitations.

When it comes down to this “Great Wealth Transfer” of Boomers to Millennials, we know one thing for sure, Bitcoin is positioned as a vehicle for the storage of newly acquired wealth. Millennials have demonstrated a strong trend of embracing the digital age with open arms while at the same time turning their backs towards the traditional financial system.